Canada’s Central Bank Is Finally Paying Attention To Home Prices

Steps In The Right Direction for The Bank of Canada

The opinions expressed here are those of the author alone and do not represent the views of any associated entities.

Back when I worked as an Interest Rate Strategist on a Bay Street trading floor, a big part of my job was covering the Bank of Canada (BoC). I left that career behind years ago but continued to keep a close eye on our central bank. Altogether, I’ve been following the BoC closely for the better part of the last decade.

A few years ago, I realized that there is a big problem with the way the governors of the BoC administer Canada’s monetary policy; they don't adequately account for the impact of interest rates on home prices. Previously, I wrote about how this oversight was on full display when home prices were not mentioned anywhere in the April 2023 interest rate hike decision announcement or the 36-page Monetary Policy Report.

Last week, I was pleasantly surprised by the BoC’s most recent interest rate announcement. For the first time that I can recall, home prices received more than just a passing mention.

This chart, taken from the BoC’s July 2023 Monetary Policy Report, depicts the evolution of home prices from 2019 until today.

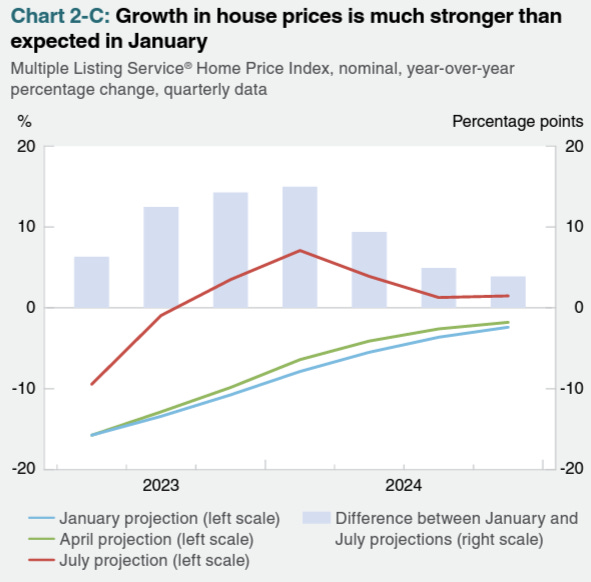

A second chart, taken from the same report, illustrates that home prices are growing much faster than expected earlier in the year.

Although the inclusion of these charts might not seem like a big deal, this is a significant step for the BoC.

In 2021, when home affordability was crushed by prices that skyrocketed by over 20%, similar mentions of home prices were nowhere to be found in the BoC’s communications. Back then, home prices were not on the BoC’s radar. In all of my time following the BoC, this is the most detailed discussion of home prices that I’ve seen.

I’m hopeful that this focus on housing is not a one-off occurrence, and that the efforts of myself and others to push for home prices to play a more pivotal role in our monetary policy decisions have finally started to pay dividends.

Through my work with Generation Squeeze, I’ve had the chance to be involved in meetings with numerous government officials whose roles relate to the issue of the BoC setting interest rates without adequately considering the consequences for home prices. Last year, we met with advisors to the Minister of Finance, who is responsible for the BoC, and advisors to the Minister of Innovation, Science, and Industry, who is responsible for Statistics Canada; they were supportive of our cause.

Statistics Canada plays a crucial role in how home prices are considered in our monetary policy decisions. One of the main reasons why the BoC has not adequately accounted for home prices when setting interest rates is that the BoC relies on Statistics Canada’s inflation data. Statistics Canada measures inflation using CPI, which does not account for the cost of purchasing a home. A couple of months ago we met with Statistics Canada regarding this issue; they were receptive to our concerns.

As Jagmeet Singh recently mentioned on the Generation Squeeze podcast, we didn’t end up in the mess we are in today by accident. Decisions and policies made in the past got us here. This means that we have the power to influence our future course. Seeing the BoC take this step in the right direction has further convinced me that change is possible if we put some effort into fighting for what we believe in.

That being said, this problem has not yet been solved. The BoC may be paying more attention to home prices but is still setting interest rates based on an inflation gauge that does not account for the cost of purchasing a home. So please, share this newsletter and these ideas widely. The more people that know about and advocate for this issue to be resolved, the more likely it is to happen.

That’s all for this time.

As always, I would love to hear any thoughts, comments, or concerns you might have. Feel free to reach out!

Thanks for reading,

Kareem