The Canadian real estate market is in the midst of its first major slowdown in many years. It’s hard to believe, but this only happened by chance.

In my most recent article for Generation Squeeze, I explain how we’ve only inadvertently managed to rein in out-of-control home prices. Additionally, I explore why the slowdown probably won’t last unless we address certain underlying issues.

You can read the full article on the Generation Squeeze website, or directly below.

Back when I worked in finance, my job was to design interest rate-based trading strategies. I would spend my days devouring information and building models to predict how interest rates might evolve. Days when economic data were released, such as CPI or employment figures, were always exciting – an unexpected print could send the market into a frenzy. The most crucial moments, however, revolved around the Canadian and US central banks. We would analyze every press release or speech meticulously, word by word, to try and gain any insight into how things might unfold.

I remember realizing, through my research at that job, that interest rates have a massive influence on our everyday life. Yet few people I spoke to outside of the industry had any idea about the mechanics behind how interest rates were set. This isn’t surprising, considering that interest rates had been historically low since the 2008 recession. Many people had never experienced a world without low interest rates and had no reason to question them.

How times have changed! Over the last year, the Bank of Canada has hiked interest rates repeatedly and dramatically to combat record levels of inflation. These higher interest rates have driven up the cost of borrowing. Many people with mortgages are paying more each month, and those looking to buy a home are finding it harder to fund their purchase.

One much-publicized result has been a slowdown in Canada’s housing market, where the most significant impacts of higher interest rates have been felt. According to the Canadian Real Estate Association MLS Home Price Index, prices have fallen 17.4% from their peak in March 2022.

This cooling of our housing market is often portrayed as a bad thing, a marker of economic ‘weakness’ from which we need to ‘recover’. Take these media headlines, for example:

“The worst in the housing market price decline is over, and the recovery will soon be underway.”, The Toronto Star

“Canada’s housing market weakness has been driven by higher interest rates.”, Bloomberg

If your view is that housing is an investment meant to produce profits – something that many of us might think – it’s easy to see the current market ‘weakness’ as a personal financial risk. The media helps us along with this interpretation, by reporting that falling prices are putting the equity of homeowners at risk.

But here’s what they don’t tell you. While prices have dropped from their frenzied high point last spring, prices in Canada’s hottest markets were still higher, on average, in 2022 than they were in 2021. According to Canadian Real Estate Association data, in 2022 the average home price in Ontario was $932k, compared to $873k in 2021. In BC, average home prices were $997k in 2022, up from $928k in 2021. The same goes for the highest-cost markets of Greater Toronto and Metro Vancouver. In both, the average home price increased by nearly $100k from 2021 to 2022.

The bottom line is that even though home prices have fallen from their peak, purchasing a home last year was still more expensive than in any previous year. Not only has recent media coverage tended to overlook this important context about home prices, but it has also generally failed to explore another side of the housing market slowdown. That is, the positive impact it could have on the affordability of homes, especially for younger people and newcomers to Canada.

After decades of relentless price growth, a dip in the cost of housing would be welcome news to many hoping to one day own a home. Home prices that stall – or even fall moderately – are one way to help earnings catch up, to close the growing gap between the major cost of living (purchasing a home) and what Canadians earn from their hard work.

If you’re among those who are happy about the slowdown in the housing market, we have some bad news.

We’ve done nothing to fix the underlying problems that contributed to home prices rising a whopping 318% since the year 2000.

You see, while rising interest rates have helped cool the housing market, the reason interest rates rose has little to do with home prices. That’s because of a flaw in the primary indicator our economic leaders use to measure inflation, and then set interest rates: the Consumer Price Index (CPI). CPI does not adequately account for the biggest cost Canadians face – the cost of purchasing a home. This is why when home prices rose by 21% in 2021, inflation was still only around 4% according to CPI.

The Bank of Canada only began to raise interest rates in response to climbing prices for things like fuel, food, and transportation, due to supply chain and other issues. The increase in the prices of these everyday goods is why interest rates are currently higher than they’ve been in many years.

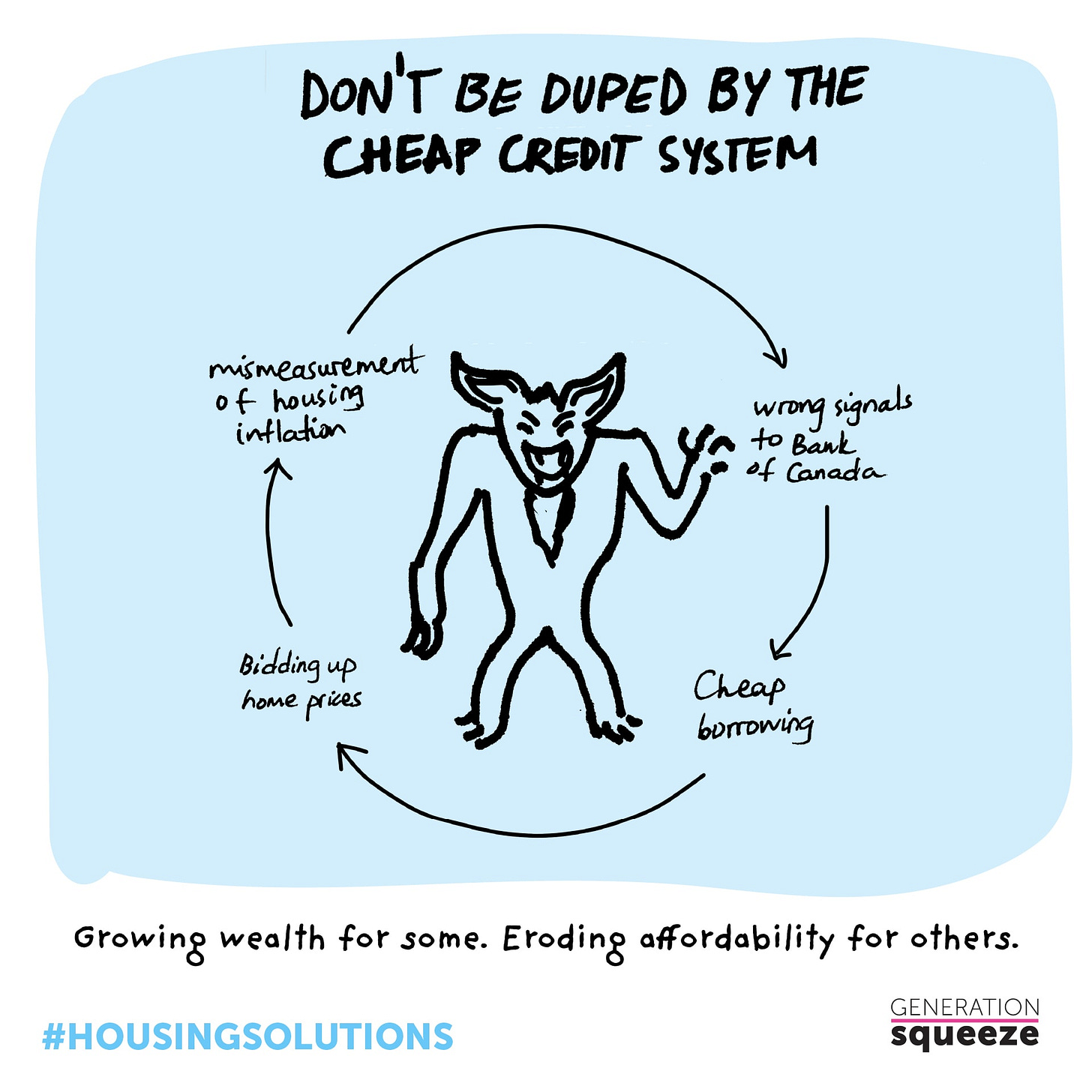

It’s scary to think that we’ve only managed to slow down our out-of-control housing market as a side effect of our attempts to deal with the rising cost of other smaller purchases. If it weren’t for the pandemic-driven supply shortages, The Bank of Canada likely would have continued to allow housing price inflation to run rampant by keeping interest rates low – fueling what we at Gen Squeeze call the cheap credit system.

As Gen Squeeze has previously described, cheap credit allows everyone to qualify for huge mortgages that they use to bid up home prices. Since rising home prices aren’t captured in CPI, they aren’t adequately considered in the Bank of Canada’s decision-making process. Interest rates stay low and credit remains cheap, allowing home prices to get bid up still further… and the cycle continues.

Last year we brought this issue to Statistics Canada, the government agency responsible for the CPI, but they weren’t very enthusiastic about making changes to how they measure inflation. Now that it has become clear that interest rates are an economic lever that can be used to influence the housing market, we’re hopeful their view might change. We need our economic decision-makers to be equipped with accurate inflation data. If they had been previously, perhaps we could have avoided some of the worst harms of unaffordable housing.

We can’t rewrite the past – but we can make sure we don’t repeat our mistakes. If we continue to rely on an inflation measure that doesn’t account for the cost of purchasing a home, we’ll likely end up right back where we were before interest rates started rising last year. In the vicious circle of the cheap credit system, further eroding affordability.

Governments are designing and implementing their budgets right now. One commitment we’re encouraging them to make is solving our inflation measurement issue. No new money is needed to address this problem. Only technical changes to our inflation measurement process – and political will – are required.

You can contribute to our efforts by joining the Generation Squeeze network and spreading the word by sharing this article.

That’s all for this time.

I would love to hear any thoughts, comments, or concerns you might have about all of this. Feel free to reach out!

Thanks for reading,

Kareem

I don’t understand why you concentrate on issues that are meant to slow growth. It is clear to me that when the government does not support the growth of housing supply whether it be purchase or rental without controlling the amount of immigration that they allowed to take place there is a disconnect in my mind of the issues that are caused by the government.