Will Building More Homes Solve Our Affordability Issues?

This problem is too big to be tackled by any single solution

Welcome to the first edition of People Over Profits.

Today I’d like to share with you an article that I wrote for Generation Squeeze, where I delve into some influential (but infrequently discussed) forces that helped to make housing in Canada so unaffordable. In particular, we’ll examine how our tendency to think about homes as investments rather than places to live is harmful to affordability, and a great example of how we tend to put Profits before People.

My goal for People Over Profits is not to create another venue for ruminating about how bad things are (there are already enough of those), instead, I hope that this can become a space to engage in productive discussions about how to fix our problems. So, at the end of the article, you’ll see some ideas about how we can improve things going forward. I’d love to hear what you think!

You can either read the article below or directly on the Generation Squeeze website.

What you don’t know about the investors driving up housing demand (and prices)

One of the things that I missed most during the pandemic was traveling. Recently, I was fortunate enough to take a trip to Europe. I always find it refreshing to go somewhere different. Breaking out of my everyday routine usually allows me to see things with a new perspective, and this trip was no different. When I returned, I found that I appreciated all of the comforts of home, like my comfortable bed and well-stocked tea cupboard, more than I did before I left.

But not everything felt better under this revived, post-vacation outlook. Something off-putting that I began to notice was how much our lives revolve around the housing market here in Canada. It feels like every conversation ends up in the same place: Did you see how much that house sold for?!?

Many people who got into the housing market years ago have become millionaires, thanks to decades of rising prices. Those who weren’t fortunate enough to be able to buy a home before prices went sky-high have been left scrambling to find a way to live close to their jobs or the people they love, usually by taking on massive mortgages, or paying higher and higher rents each year. So it’s not really that surprising that we’re obsessed with housing, is it?

When we aren’t fixating on property values, conversations often turn to reasons why housing is so unaffordable. One culprit that’s often mentioned is a shortage of homes. My Linkedin feed is packed with economists sounding the alarm on supply, not to mention that supply was identified as the “core issue” by our finance Minister earlier this year.

Low supply isn’t the only cause of unaffordable housing

Canadians are well aware that supply issues are worsening housing affordability: 60% of people surveyed earlier this year by Gen Squeeze identified a lack of properties available for purchase as a significant factor contributing to housing unaffordability. Most Canadians are also supportive of actions that aim to beef up supply, with 67% agreeing that building additional homes would contribute to more reasonable housing prices.

We might all agree that Canada needs to build more homes. But it’s clear from Gen Squeeze’s comprehensive housing policy solutions framework that supply isn’t a silver bullet. Increasing the number of homes can help push down prices – but decreasing demand can have the same effect. Supply and demand are two sides of the same coin, but we tend to discuss the former as a potential solution far more than the latter.

The impact of demand on home values has become especially visible of late. Higher interest rates are making mortgages more expensive, decreasing the number of people looking to buy a home. As we hear just about every day in the media, the result is a ‘cooling’ of the housing market.

Decreasing demand appears to be helping affordability. In recent months, we’ve witnessed home prices stall – or even fall moderately in some markets. But despite the hype, it’s important to observe that prices have only dropped back to where they were in 2021. We’re still nowhere close to having housing that’s affordable, which Gen Squeeze considers to be home prices that are within reach of average local earnings. The gap between home prices and earnings remains a chasm, as discussed in this recent report.

Prior to recent dips, demand for housing had been exorbitant for years. This situation was fuelled by exceptionally low-interest rates that provided cheap financing for home purchases, making it easier for buyers to borrow more and bid up prices. For now, rising interest rates are checking this trend – but if we don’t remedy the root causes, it may prove to be a temporary pause. To determine how to prevent demand from running rampant again in the future, we need to understand how it got so out of control in the past.

What drives demand for housing?

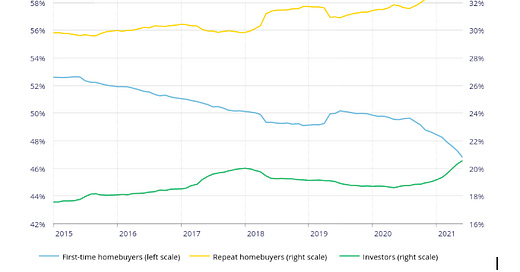

According to the Bank of Canada, about half of all homes are purchased by first-time homebuyers, while repeat home buyers (those selling one home to buy another) make one-third of purchases. The remaining one-fifth of homes are bought by investors – those purchasing a property they don't plan to live in. Notably, over the past few years investors have been buying more homes, while first-time homebuyers have been purchasing fewer.

To me, it was surprising to learn that investors account for such a large portion of activity in the housing market. Lowering demand from this group, so that people who will actually live in the home they are purchasing (i.e. first-time home buyers), could help to make housing more affordable. Many Canadians are aware that speculation from investors drives up housing prices, with 69% of those we surveyed agreeing with this sentiment. Gen Squeeze is of the same view, which is why we argue that housing should be treated more as a place to call home, and less as an investment strategy.

Despite Canadians’ concerns about the role real estate investment plays in housing unaffordability, there remain relatively few regulations to curb this sort of demand. Jurisdictions across Canada have explored or adopted measures including penalties for house flipping, taxing vacant homes, and banning foreign home buyers. These are all important steps in the right direction, but they aren’t enough – because they target only a minority of real estate investors.

Take foreign buyer bans, for example. There’s certainly merit to stopping people who don’t live here from buying up homes for investment purposes, making these homes unavailable for residents of Canada to live in. But it’s critical to recognize that foreigners own and purchase a relatively small proportion of homes in Canada, so this measure isn’t likely to have a huge impact on overall investor demand. Foreign buyer bans target an ’easy villain’ in the housing system – someone who most people don’t mind targeting, because it doesn't affect them.

Housing wealth has turned regular Canadian homeowners into investors

In reality, many ‘investors’ in Canadian real estate are everyday people. They are homeowners who gained tremendous wealth in recent decades thanks to the rising value of their home, and then leveraged this wealth to purchase investment properties. The fact that rising home prices have enabled many regular Canadians to invest in real estate explains why ‘investors’ own a rising proportion of homes.

When property values yield higher returns than traditional investments like stocks and bonds – not to mention being largely sheltered from taxation – they start to look like a foolproof investment. High returns from rising home prices mean more investors turn to real estate, which helps push home values ever higher. It’s a self-reinforcing feedback loop – one that has a very harmful impact on affordability for those who follow.

Our broken inflation measurement system enabled sky-high home prices

As discussed previously, one of the reasons why property values were able to rise so steadily for so long is because there’s a flaw in our inflation control system. Decades of rapidly rising home prices should have resulted in elevated inflation measurements long before recent increases in the price of things like food and fuel triggered inflation concerns.

As we’re currently witnessing, the response to escalating inflation is higher interest rates. Had spiraling home prices motivated the Bank of Canada to raise interest rates years ago, the cooling of the housing market that is happening now might have begun far sooner. Instead, because our inflation gauge doesn’t adequately account for rising property values, interest rates stayed low, providing fuel for further speculation.

There’s no single solution that will solve our housing affordability issues. We need to make use of every available measure to ensure all Canadians can afford a place to call home. Fixing our inflation control system will help protect against cheap debt fuelling another cycle of home price increases once prices for other goods have moderated. This is an attractive solution in terms of cost - it’s essentially free to make updates to the way we measure inflation. All we need is for our political leaders to lead the way on tasking Statistics Canada to make the needed changes.

That’s all for today. I would appreciate any feedback you have, which you can send by either responding directly to this email or leaving a comment on Substack.

Thanks for reading,

Kareem